The title should be no surprise by now. Paul Krugman–arch-Keynesian–is once again misrepresenting what Austrian economics is. Krugman thinks the recent financial crisis can test (and prove) the superiority of Keynes prescriptions for an ailing economy.

Before we delve into the specifics, consider the alternatives Krugman proposes: classical economics (he considers Austrian among them) and Keynes. The concept of “classical economics” really refers to an amorphous blob of economists during a certain time period.

When people like Krugman say “classical economics,” they are using a filler word: there was no consensus “classical” opinion. I can say “classical” economics teaches this, list a single author, and then move along, ignoring the fact another “classical” economist strongly disagreed.

More importantly, Krugman simply does not understand the Austrian position. By casually tossing them in among “classical” economists, he presents an obvious straw-man.

Krugman gives three indications that allegedly rule in favor of Keynes:

1) Keynesians: interest rates will stay low during depressions. Classical/Austrian: budget deficits will drive interest rates up

2) Keynesians: Austerity will make things worse. Classical/Austrian: Austerity will help the private sector recover

3) Keynesians: Stimulus funds will not cause inflation. C/A: Stimulus will cause rampant inflation.

As events played out, the Keynesian story makes much more sense. Presenting anything in such simple terms can make anything, even something as complicated as macro-economics, seem simple. Let’s take each in turn.

1) The presentation here is uncharitable. True, when governments borrow trillions of dollars, the costs of borrowing go up as banks and lenders grow concerned about repayment.

Things are different when the government is printing money than loaning it to itself. I would expect interest rates to stay low given QE1 QE2, and QE3. Budget deficits are not the only government factor that influence interest rates. The Fed has massive influence on interest rates, so it can keep them artificially low to counteract rates that might want to rise.

2) This one is actually true. But as as I’ve pointed out elsewhere, “austerity” does not necessarily mean countries are spending less. Britain is a great example as they are in a double-dip recession. Pundits and economists everywhere think they are on a vicious austerity program, when in reality cuts have been delayed and government debt and spending have increased. Austerity should mean cutting government spending and retiring debt.

In fact, Krugman’s misconception about European austerity earned him a tongue -lashing from Estonia’s President earlier this month.

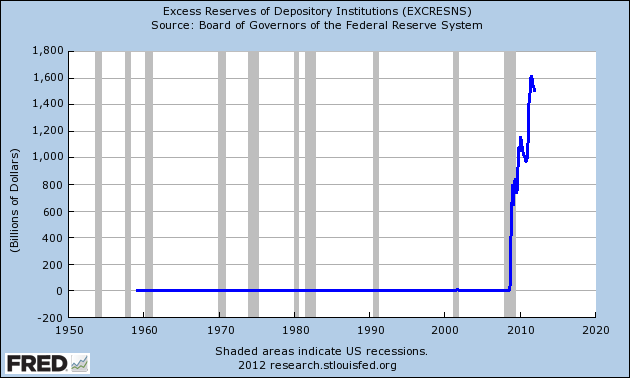

3) Here again Krugman leaves out critical data. It would be one thing to say the government created more money, there was no inflation, therefore Keynes. This graph destroys that logic

All the money the Fed has printed is idling in banks! When that money begins to leak out of banks into consumer wallets (as Bernanke desperately wants), then we should expect inflation. If the money becomes more loans, then expect asset inflation. Until then, Krugman has not proven anything.

Krugman dedicates the rest of his article to his third point. He debunks the idea the false data or core inflation are hiding the real inflation, but never bothers to consider the obvious.

No comments yet.