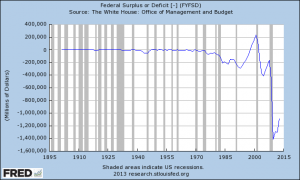

There is a curious rumor going around. Allegedly, the Obama Administration is producing a shrinking federal deficit. Paul Krugman has even picked up this rumor in his NYT column. Is there any traction to the dubious assertion that the administration is fiscally sane?

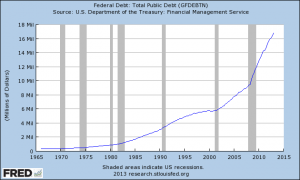

There is a difference between the national debt and the deficit. The national debt is the year over year accumulated debt of the nation while the deficit is a yearly measure of how much the government overspent relative to tax revenue.

The CBO released a report which records a shrinking deficit. Indeed, the deficit is the smallest it has been in 5 years. It’s shrunk from a local maximum of $1.29T in 2009 to $1.08T in 2012. As long as deficits are present, the national debt increases. Almost 6 years in, and Obama’s economy isn’t doing well at all-by any measure.

http://research.stlouisfed.org/fred2/series/FYFSD

The recession has taken a bite out of tax revenues as a percentage of GDP, but the government’s tax haul is larger than it’s ever been. Despite record tax collection, Obama is running yearly deficits larger than FDR did during the Great Depression and WWII. Under Obama, the debt has increased at an unprecedented rate because his deficits are unprecedentedly high.

http://research.stlouisfed.org/fred2/series/GFDEBTN

Word Games:

Small deficits alone are no sure indicator of pro-growth policies. The federal budget deficit is a combination of expenditures and tax revenues. If spending is high, but taxation is raised alongside it, this means little. If the government produces smaller deficits by increased taxes, it’s just a sign that the government is taxing citizens at enormous rate. High taxation and high spending might produce a smaller deficit but this is hardly beneficial.

The Deficit and The CBO

Some understand the nature of the deficit, and what it means. They insist, though, that the shrinking deficit constitutes a sure trend. In a matter of years, an Obama Administration would start to produce yearly budget surpluses-which could then be used to pay down the national debt. Indeed, CBO projections do seem to bear out this conclusion. Is this a sure bet? No.

CBO projections are helpful to an extent. Ezra Kline explains that projections are only useful when looking at the short term, and looking at specific program funding regimes. Staking Obama’s deficit turnaround on a 10 year CBO projection is folly-it’s downright scientism! CBO models are notoriously unreliable sources of long term forecasting.

No comments yet.