Would a 3rd Round of Fed Quantitative Easing be a charm?

Matthew O’Brien, writing last week for The Atlantic, certainly feels it would be. Those who share his sentiments were disappointed when Fed Chairman Ben Bernanke in his hearing before Congress stated “monetary policy is not a panacea”, which many have interpreted as a sign that a third round of quantitative easing (QE3) will not be implemented in the immediate future. O’Brien claims that this would be the perfect time for QE3. Why? Because America’s Gross Domestic Product is still not reaching its full potential as calculated by the Fed. Just as importantly, O’Brien argues, people are not expecting QE3 at the moment.

Therefore, if implemented now, it would have a dramatic, positive effect on the economy. Great optimism would spontaneously spread throughout the market, stimulating the animal spirits to boost GDP up to, and quite possibly beyond, its potential.

But Mr. O’Brien is wrong. Below, I will attempt to clearly explain what quantitative easing is and three simple reasons why it is undesirable and downright harmful for economic recovery.

Quantitative easing simply refers to when a central bank (the Federal Reserve in America’s case) continues to inject new reserves into the banking system when interest rates are already at or near 0%. The Fed injects these new reserves by buying government securities (T-bills and bonds) from banks. This is formally called “open market purchases” by the Fed. The purchasing of these bonds pushes the Fed Funds rate (the rate at which bank’s charge one another for overnight loans) lower, encouraging a greater amount of lending between banks and ultimately from banks to borrowers. Keeping credit flowing from banks has been priority #1 for Bernanke, hence the all-time low we have seen in the Fed Funds rate during his term. The Fed Funds rate has been equal to or less than .2% since December 2008. This policy by itself involves a great amount of bond purchases by the Fed. Quantitative easing implies that even after the Fed has purchased enough government securities to push the Fed Funds rate to basically 0%, it injects even more money into the banking system. The ultimate objective of the policy is to keep credit flowing from banks as well as inspire greater confidence in the health of the economy.

Why it Would not be a Charm

Reason #1: The Nature of Credit Expansion

Unfortunately, this policy rests on the belief that immense amounts of credit expansion will lead to economic recovery. Sound economics shows this to be the farthest thing from the truth. When the Fed decides to print more money and inject it into the banking industry, it actually fosters economic volatility rather than curbs it. Austrian Business Cycle Theory, explained here, shows that credit expansion by central banks creates an artificial boom in economic activity. Investment and consumption are stimulated temporarily and therefore it seems like the economy is healthier than it was before. However, those people investing on the market are not using resources that have been saved by other market participants. Rather, the Fed has printed the money being exchanged out of thin air. The injection of this money into the economy changes the structure of production in an unsustainable way. This is precisely because the changes are not the result of decisions made by market participants. Resources have not been saved by individuals to support the new structure of production. Eventually, the boom turns to bust when the preferences of individuals reassert themselves and we are left with a state of economic affairs which is inferior to the one before credit expansion.

Reason #2: Inflation

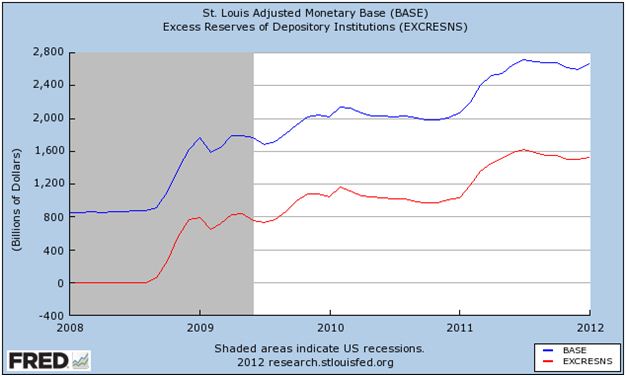

Quantitative easing inflates and therefore depreciates the value of the US dollar. The chart below shows the massive increase in the monetary base in the past four years.

The blue line represents the increase in the total monetary base while the red line represents the increase in money held by banks which they do not have to hold. If they chose to, they could lend out their excess reserves. Quantitative easing encourages banks to lend out more of this money. As this money enters into the economy, we have good reason to believe that we will see price inflation. This inflation will only make it more difficult for businesses to calculate revenues and expenses and employ the very people who will have to pay more for goods and services.

Reason #3 QE Discourages Real Savings

Lastly, and just as importantly, quantitative easing makes it less appealing for people to save and invest their resources. The voluntary saving and investing of real resources by individuals is the path to sustainable improvements in living standards. People will be more willing to save and invest if they earn a higher rate of return on their investment and less willing at a lower rate of return. The following chart shows how the Fed’s expansionary policy has discouraged savings.

Because the Fed has injected so much cash into the banking system, banks have literally more than enough of it. Therefore banks have little incentive to provide much of a return at all on their customers’ savings accounts. This explains why anyone who has saved their money in a 6 month cd with a bank in the past 2 years has earned no more than a pitiful 0.5% in interest.

While not an exhaustive list, I strongly believe the points made above provide more than enough reason to believe that further quantitative easing will not bring about real economic recovery and only serve to further damage an already injured US economy.

The facts do not back up your third point, below is gross private saving over the past 5 years, if the low interest rates really were a disincentive to save, we would certainly see it here:

http://research.stlouisfed.org/fred2/graph/?chart_type=line&s%5B1%5D%5Bid%5D=GPSAVE&s%5B1%5D%5Brange%5D=5yrs

Gross private saving didn’t increase until after interest rates hit the zero lower bound.

In this instance low interest rates are a reflection of tight monetary policy not loose. As Kurt Schuler would remind us, the goal of monetary policy is to maintain the neutrality of money. And if the demand for money increases 4 times yet the supply only 3, you have tightened monetary policy.

Link is wrong above: http://research.stlouisfed.org/fredgraph.png?g=5xh

The facts presented by your graph are not necessarily relevant to the author’s point as I read it. Gross private saving is an aggregate picture of saving, while the author was speaking about one specific aspect of that aggregate (personal savings). We can infer nothing about personal savings from that graph. A graph of the personal savings rate is more instructive, and here we can clearly see that while the savings rate is higher now than before the crisis, it has clearly dropped from the substantially higher levels consumers attempted to establish during the crisis, much of which can be attributed to the bouts of QE.

Thanks for your comment Ryan. I actually noticed that graph of gross private saving shortly after I had written this post. While it certainly demonstrates gross private saving did in fact grow, it does not prove that the low interest rates caused an increase in gross private saving. I think a more likely explanation would be that plain savings in cds was increased due to the increased volatility of the stock market. It still holds that a lower rate of interest, other things being equal, gives incentive for people to save less.

I also cannot accept the validity of a policy which tries to “maintain” the neutrality of money. Money by nature is non-neutral. An increase in the money supply will affect incomes and prices across the economy at different times and at different magnitudes. Those who receive the new money first will be in a better position than those who receive it later. The prices of various goods will not all rise simultaneously and proprtionately, but rather at different times and disproportionately on account that it takes time for new money to flow throughout the economy. Its affect is not instantaneous on all economic goods.

I also would be interested to know how the demand for money has been measured to support that we have at any point in the past four years had a “tight” monetary policy given the explosive increase in the monetary base.