There seems to be a growing trend in economics news: discredit Austrian economics. Slate did it about a week ago, and The Huffington Post, not to be outdone, did the same thing. The themes are similar, Austrians are kooky and wrong. Unfortunately, the authors fail to comprehend what Austrians are saying.

There seems to be a growing trend in economics news: discredit Austrian economics. Slate did it about a week ago, and The Huffington Post, not to be outdone, did the same thing. The themes are similar, Austrians are kooky and wrong. Unfortunately, the authors fail to comprehend what Austrians are saying.

“For them [Austrians], one dollar going into the public sector signifies the beginning of authoritarianism or social engineering: not only an unsupported slippery-slope argument, but also fear-mongering. They seem to forget that schools, hospitals, and a public infrastructure are necessary to support any healthy business environment.”

Government spending is ultimately funded by taxation or printing money. Taxation is theft (you don’t get a say in how much you pay). Printing money would be pointless if the government didn’t legally force citizens to use the US dollar. So both methods require the use of force.

Along these lines, Austrians agree that schools, hospitals, and infrastructure are good things. But funding them publicly is unnecessary. It’s not like governments invented schools, hospitals, roads and bridges. Austrians simply think that private firms are more efficient

Why? 1) Public ventures loose the profit motive to provide the best stuff 2) The government is funded by forceful extraction of wealth, so public and private funding are very different.

Private firms must compete with everyone else to buy factors, like buildings, teachers, etc. Public firms provide a service then get tax dollars to pay for it. What other company can do this? Even if you opt out of the public service, you still pay for it and it’s still provided. What a waste of resources!

“Claiming, as the Right has done, that we’ve been in a Keynesian system all along and that this is the sole reason for the current economic woes is simply not true. Saying that we’ve been under the economic paradigm formulated by the likes of Milton Friedman and the Chicago School of Economics would be a more appropriate characterization.”

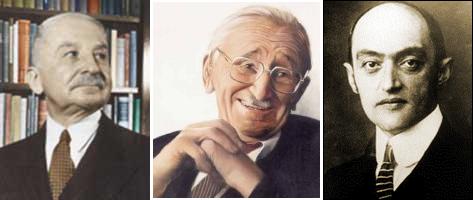

Too true. But Austrians real beef is with central banking. Both Keynesians and Monetarists believe central banks can manipulate monetary or fiscal policy to produce a healthy economy. Hayek told us it’s impossible to obtain the information required to centrally coordinate monetary policy. Mises told us that messing with interest rates will result in a credit-fueled boom followed by a bust. Both Austrians are critical of central banking, and Monetarists and Keynesians support central banking.

“Austrian Economics says that we don’t have the means to know what the economy will do, and it should be allowed to reorganize on its own, no matter how long it takes. Right now this means ‘Everybody stop spending, start cutting, and save everything. Governments shouldn’t interfere with the market, so workers may be unemployed for a long time.'”

The important issue is what we should do, not what the economy will do. This means spend and save as normal, and let the market cater to your preferences.

I take issue with the “no matter how long it takes” and “workers may be unemployed for a long time” quotes. Workers would be employed faster if wages were lower. Keeping wages artificially high stops this. By bailing out companies, governments keep unprofitable businesses under bad management.

What would happen without the bailouts? Its not like factories, workers, and capital goods disappear. Other people with new ideas buy them. So the best thing policy is to allow the bad investments to liquidate fast, so new investments can start as soon as possible.

“Austrian Economics is also highly individualistic, which isn’t true to our human nature. As a species, we wouldn’t have come so far had we not started to be more collectivist and thought not just about the individual but about the entire community.”

The term the author is looking for is “methodological individualism.” Austrians believe the proper starting point for economic analysis is the individual. Community affects are important, but how you measure them? How is the government superior in calculating social costs? The author equates community with government, which is utterly false.

“To claim, as the Austrian school does, that science, math and economic models can tell us nothing nor contribute to what we do about our future is plain silly.”

Austrians challenge the assumptions and methods of models, not all science.The point refers to how economists prove economic laws. It is simply wrong to say Austrians discredit all math and science.

Whatever tools people find is useful in prediction is based on their accuracy. Austrians are skeptical that modern modeling can take into account important factors like the structure of production, credit expansion, or the impact of artificially low interest rates. The monetary authority’s inability to predict the collapse in 2007 indicates this.

“The goals of profits – which inevitably lead to businesses’ booms and busts – should not be more important than equal rights.”

The cause of booms and busts is highly debated in economics. Keynes attributed them to “animal spirits” in investment. Friedman attributed them to sudden decreases in the supply of money. The debate over what causes them is the question at stake, not something the profession agrees on.

Profits fulfill a social function. People only make profits by providing consumers with exactly what they want. So people earning huge profits (in a free market) are giving people what they want. If people want equal rights, only companies that respect that will earn profits.

“The world, business, and the public sector are more interconnected than those in the Austrian camp acknowledge.”

Austrians stress this. The market is characterized by cooperation between workers, capitalists, companies, and others. Competition exists, and keeps costs low. So cooperation outweighs competition in the market.

“Austrian Economics advocates would say that we can get rid of central banks and that we have no obligation to our neighbors. Sorry, but it’s too late to get rid of the central banks that are so intertwined in a nation’s economy. And it’s morally bankrupt to say we have no obligation to our neighbors.”

Yes, Austrians think central banks should be abolished. No Austrians do not think that we have no obligations to out neighbors. But forcibly taking money from some people and giving it to others is not the best way to fulfill these obligations.

The central bank quip obscures the issue. If people find out how destructive its policies are, it would be gone overnight. Slavery was intertwined with out economy, and we got rid of it. Worst come to worst, the central bank will destroy the US dollar and its credibilty, like the German central bank did in the 1920’s, or the Zimbabwe central bank recently.

“Yes, there are problems (like the Euro crisis), but strengthening and refining the tools of macroeconomic management are a better answer to these issues than what Hayekians advocate: indifference.”

Indifference is not sufficient to fix the economy, central banks must be stopped from manipulating interest rates and the money supply. Wages must be allowed to fall to raise employment. Firms that go out of business are failing the social profit function, so let other people buy their assets and put them to use.

So despite her invective, Isabel Otero fails to deal with actual Austrian economics. To be fair, her piece was geared against conservative politicians. This seems laughable, since the only real politician to support Austrian positions is Ron Paul, who is barely considered a Republican. If her goal was upsetting people about conservatives, she might have succeeded. If her goal was to accurately portray Austrian ideas, give them a fair hearing, and reject them, she fails. Fortunately for Austrians, poor research will be noticed and corrected. As people demand to know more about Austrian economics, real Austrian ideas will be in high demand. We at Hans Economics couldn’t be more excited.

[youtube http://www.youtube.com/watch?v=GTQnarzmTOc&w=560&h=315]

No comments yet.