Economist Brad DeLong wrote on his blog yesterday about Paul Krugman’s “A Note on the Ricardian Equivalence Argument Against Stimulus.” While the post was quite complex and requires a previous knowledge of Krugman’s argument, he makes one claim I would like to point out.

“He gets it completely wrong because Krugman knows very well who lent the money to the government (to fund deficit spending): it’s the workers who would otherwise have been employed and the shareholders who would otherwise have had no dividends who lent the money to the government. Where did they get the extra money? From their extra income. Why do they have extra income? Because there is extra demand. Why is there extra demand? Because the government borrowed-and-spent the money? What money did the government borrow? The money lent out by the workers who got the extra work and the shareholders who got the extra profits. It’s a circular flow.“

In case you didn’t catch his drift, DeLong is arguing that deficit spending is funded by those who benefit from it…those who would otherwise have been unemployed, who collected dividends after lending to the government, and whose incomes increased directly because of the deficit spending.

This is all part of what economist call circular flow. It is the mainstream way of understanding production and consumption in the economy. It is not without critics however. Indeed, the problems with the circular flow diagram as a way to model and understand the flow of money in the economy are many.

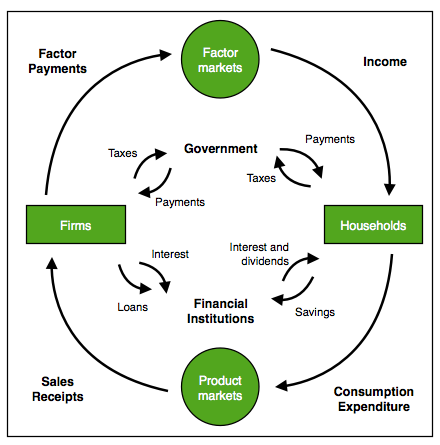

Here is the diagram itself:

As you can see, the circular flow diagram highlights the relationship between the household and the business firm as the source of economic activity. Firms use labor from households and other factors of production to create goods which are sold to households, which in turn own the factors of production which are sold to firms in the factors market.

But what the circular flow diagram ignores the beginning and end of the economic process. According to the circular flow diagram, economic activity is circular (thus, circular flow). This, by definition, means it establishes no beginning or end to the economic process. It follows, then, that believers in circular flow must believe that, in the same way people produce in order to consume (a self-evident fact), they consume in order to produce. This is not the case, however, as established by Carl Menger. As Simpson and Kjar write (in a paper I highly recommend):

“The circular-flow diagram’s greatest problem is, in fact, its circularity. While real-world economic analysis has a beginning, an ending, and ever-changing processes, thecircular-f low diagram has no beginning or ending. It is drawn as though entire macroeconomies sprang into existence from whole cloth. While the circular f low appears to be dynamic, it allows no room for change on any margin: consumer preference, production technique, or availability of factors of production…

“One of the problems with such circularity is that there is no beginning or end to the economic process. According to Menger’s formulation of economics, the beginning and end of economics is a human need. This human need or “feeling of uneasiness” (Mises 1998, p. 13) is a necessary cause of human action. Without a human need, there is no reason for the human to act to quell this uneasiness. The economic process ends with the satisfaction of the

human need. Menger’s formulation highlights the fact that economics deals with human beings, their needs, and the subsequent satisfaction of such needs.”

All this goes to say that the circular flow diagram is a flawed way of thinking about the economy. DeLong can use it (as he did) to justify deficit spending as government policy, but a flawed perspective of the economy–especially in this case–leads to inaccurate and harmful conclusions. I won’t go in to why deficit spending as government policy is counter-productive in this post, but suffice it to say: Don’t let a justification for deficit spending from a circular flow point of view convince you that it is economically beneficial, for the very idea of circular flow has many problems of its own.

http://mises.org/daily/3194

In this excellent article, Murphy argues that circular flow model might be appropriate for a “two-goods-economy,” but not one that is more complex. The circular flow model fails to account for the fact the production takes time and that real production is comprised of a highly complex series of stages. It is not the simplistic, self-reinforcing “circle” of the Keynesians.