Leave it to Paul Krugman to try and invalidate Austrian economic theory with a measly 3-year inflation figure:

Leave it to Paul Krugman to try and invalidate Austrian economic theory with a measly 3-year inflation figure:

“Austrians…were sure about what would happen as a result: There would be devastating inflation. One popular Austrian commentator who advised (Ron) Paul, Peter Schiff, even warned…of the possibility of Zimbabwe-style hyperinflation in the near future.

“So here we are, three years later. How’s it going? Inflation has fluctuated, but, at the end of the day, consumer prices have risen just 4.5 percent, meaning an average annual inflation rate of only 1.5 percent. Who could have predicted that printing so much money would cause so little inflation? Well, I could. And did. And so did others who understand the Keynesian economics (Ron) Paul reviles. But (Ron) Paul’s supporters continue to claim, somehow, that he has been right about everything.

“‘Aggressive monetary policy can reduce the depth of a recession,’ declared the 2004 Economic Report of the President.”

Now I’m not out to defend everything Ron Paul says (yes, I know…), but I will defend sound economics. Fact is: it’s not just over the past three years that the Fed has engaged in “aggressive monetary policy”. Indeed, “aggressive monetary policy” has been happening for decades now. Under Greenspan, the federal funds rate dropped from 6% to 1% in just four years. Bernanke followed suit, dropping it to near-zero after the 2008 collapse. If we had anything before the recession, it was “aggressive monetary policy”. So not only does “aggressive monetary policy” reduce the depth of a recession (a claim which itself is incorrect), but it causes them in the first place.

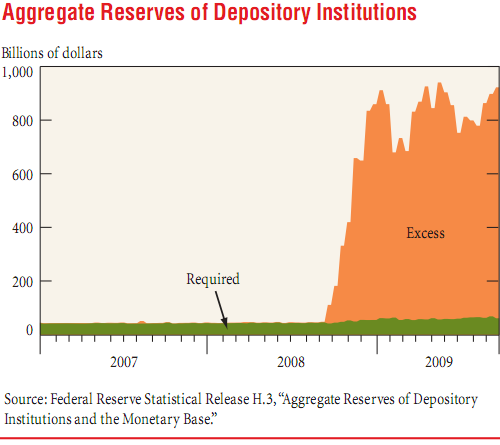

Also: It’s hardly fair to write off Austrian warnings of inflation after just three years. Yes, we have not seen “Zimbabwe-style hyperinflation”, but even Krugman knows that banks are currently sitting on reserves higher than any other point in history. Some thoughts on that from Austrian economist Mark Thornton:

“…the impact of monetary inflation on the overall economy takes time. Money that enters an economy moves from one sector to another and eventually throughout most of the economy. Anyone familiar with basic money and banking would know this. Anyone familiar with reading the business sector of the newspaper would know that banks have largely been “sitting on” the Fed’s increase in the monetary base and that most of the new money has really not even entered the economy yet.”

Part of Krugman’s error stems from the mainstream view that inflation = rising prices. Inflation is better defined as an increase in the money supply. Under this definition, if prices are higher than they *would* be absent the monetary inflation, then “inflation” has occurred. And there is no way to determine what the overall price level *should* be. It’s just as likely that without the monetary inflation, overall prices would be lower.